Property Spreadsheet with Free Rental Property Spreadsheet Template And Free Excel —

Example: capital gains on the sale of a co-owned rental property. Karl and Louisa bought a residential rental property in November 2016 for a purchase price of $750,000. They incur costs of purchase, including stamp duty and legal fees, of $30,000. After purchase they improved the property by constructing a fence for $6,000.

Rental Property Spreadsheet Australia with Rental Expense Spreadsheet Property Expenses Template

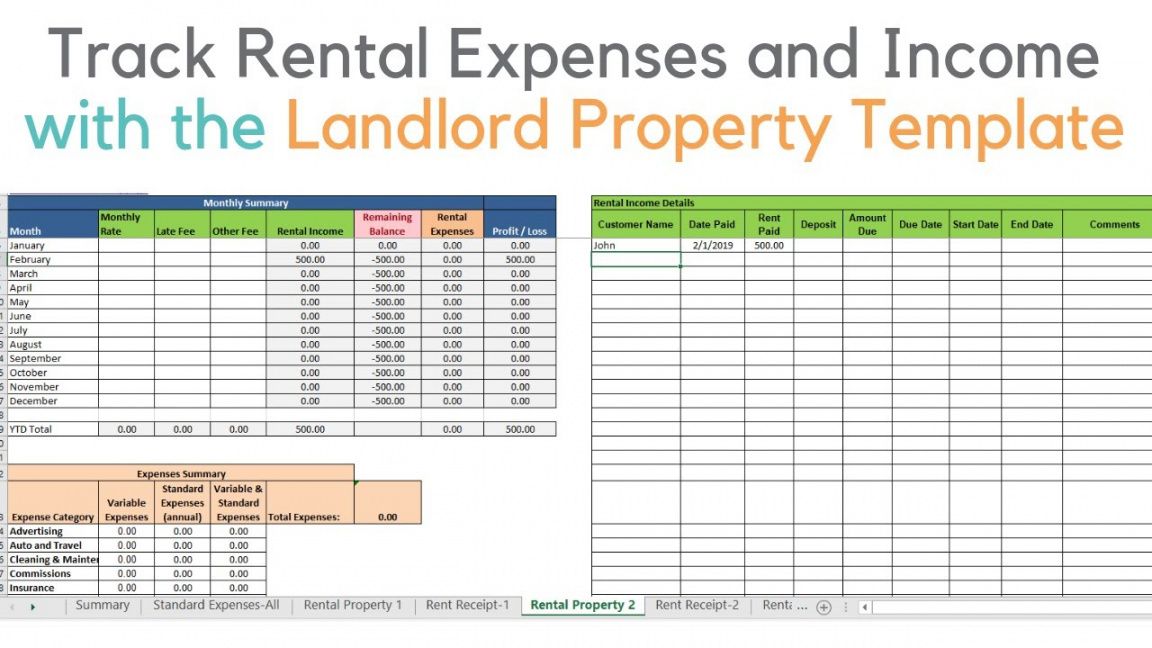

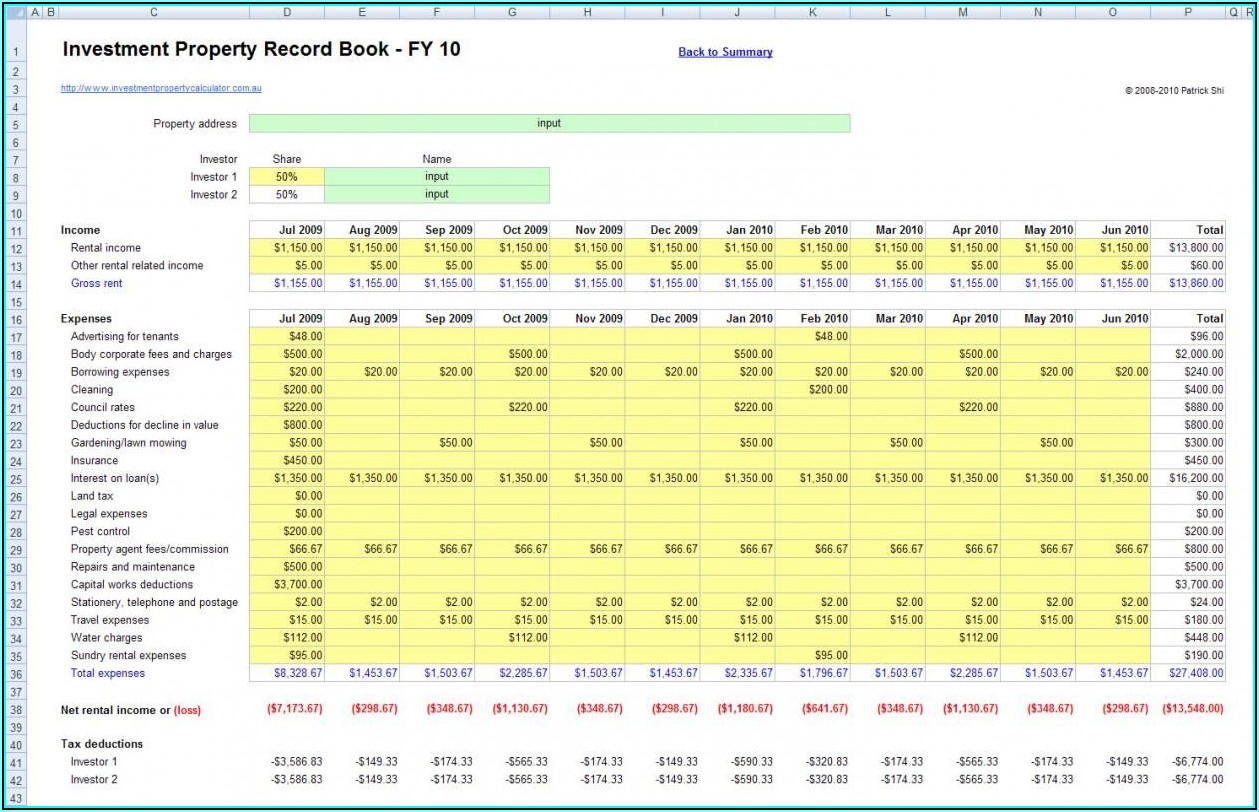

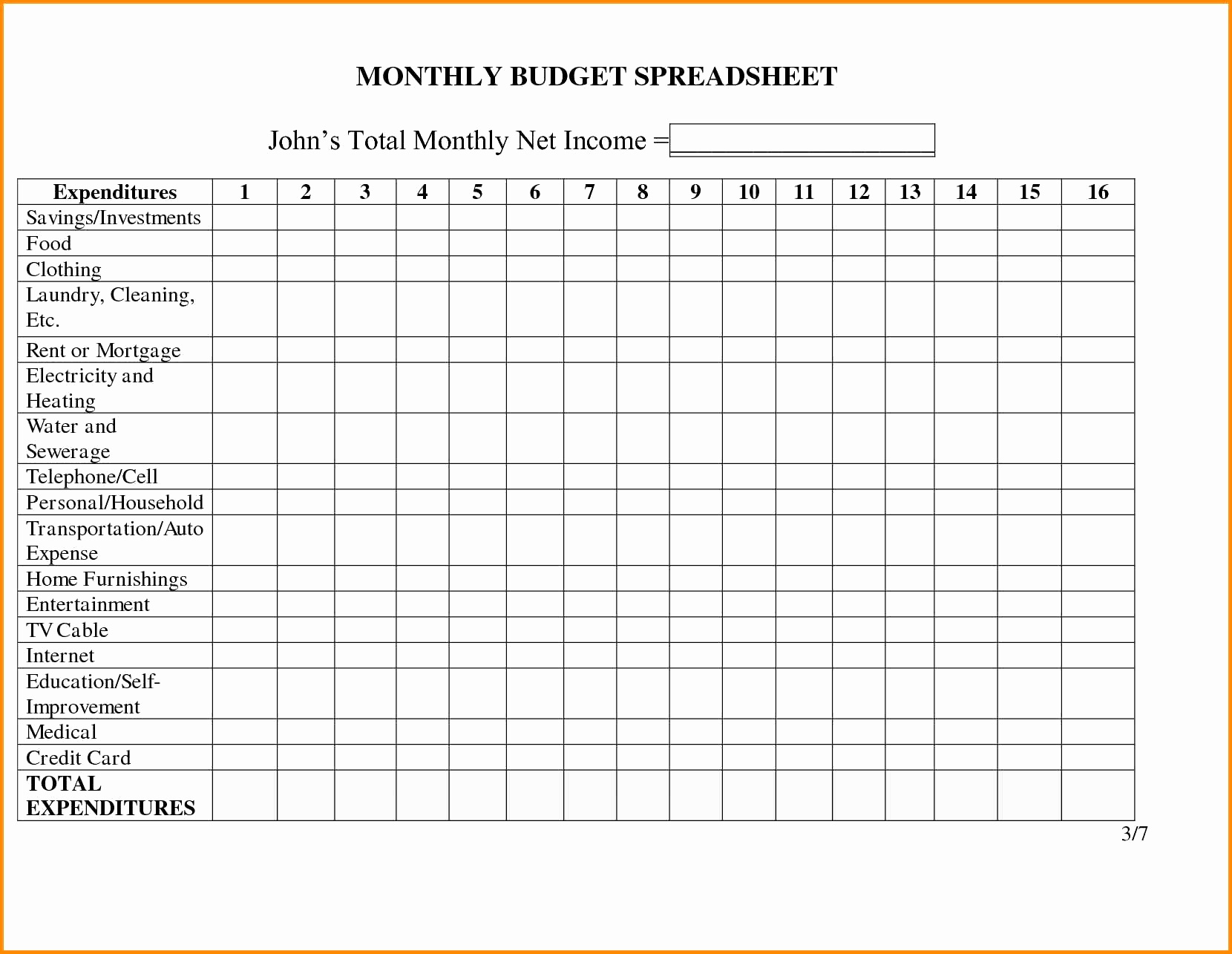

Basic Investment Property Calculator. This basic investment property calculator (free for personal use) is built based on ATO rental property spreadsheet. It automatically calculates the income tax before and after deductions. It in addition shows the gross rental yield of your investment property. Learn More & Download It Now.

Rental Property Tracker Spreadsheet within Rental Property Tracking Spreadsheet Template

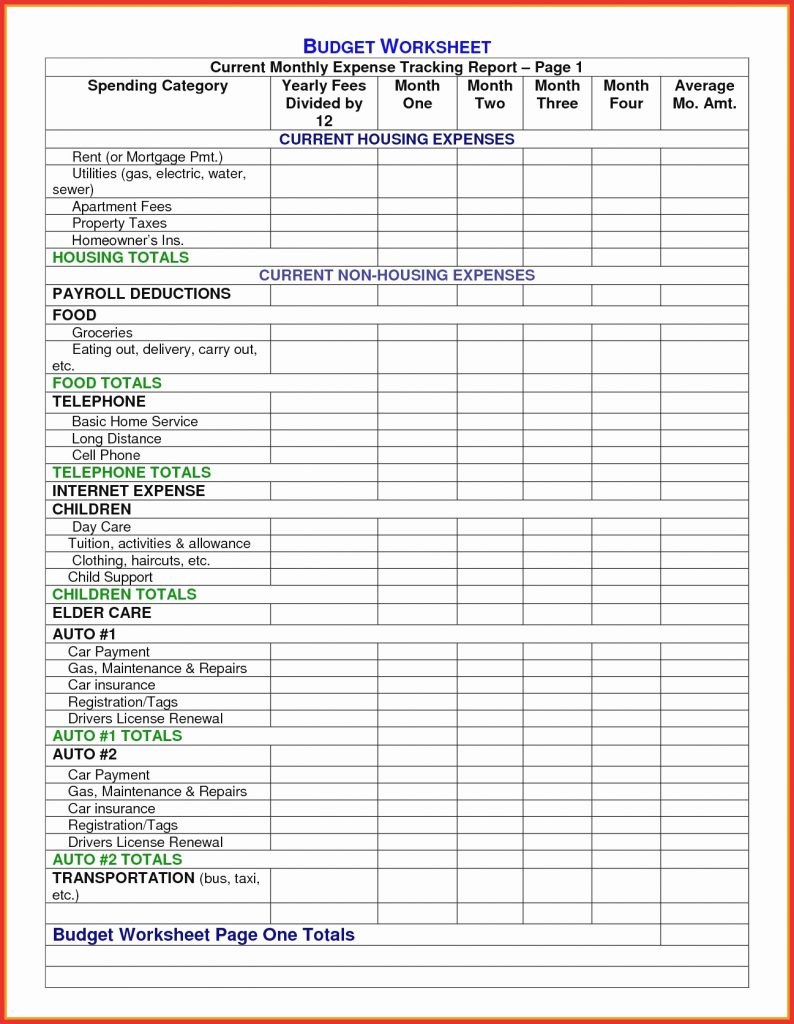

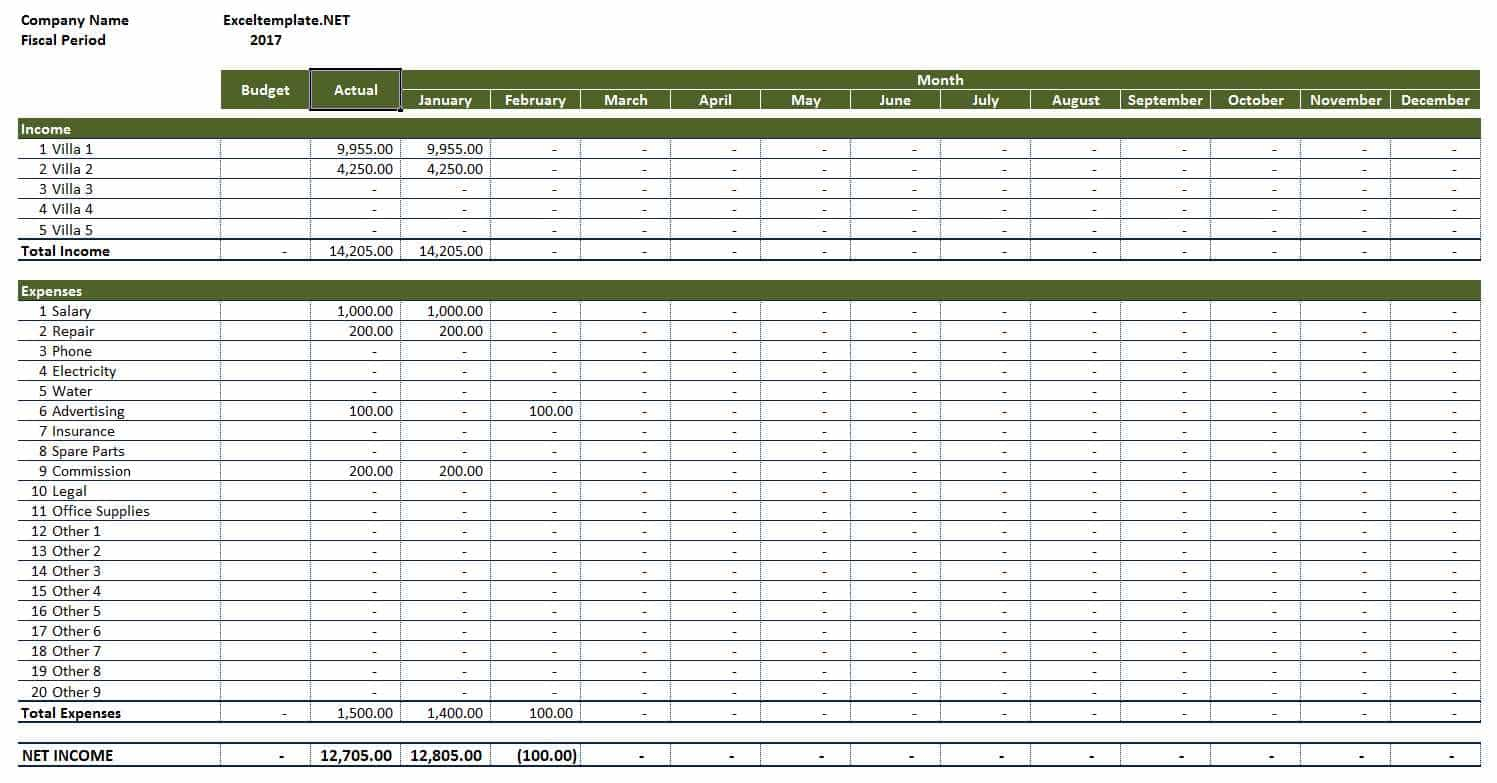

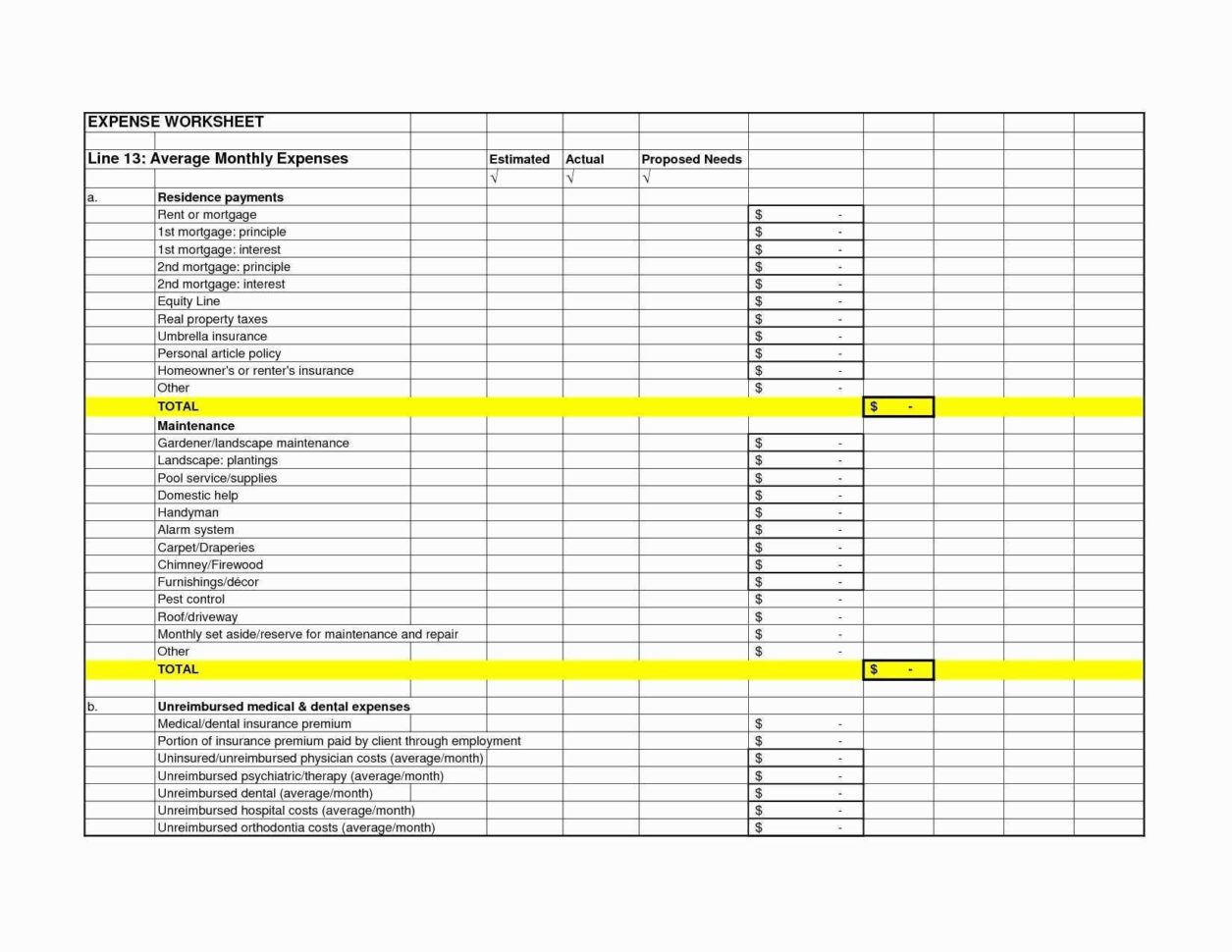

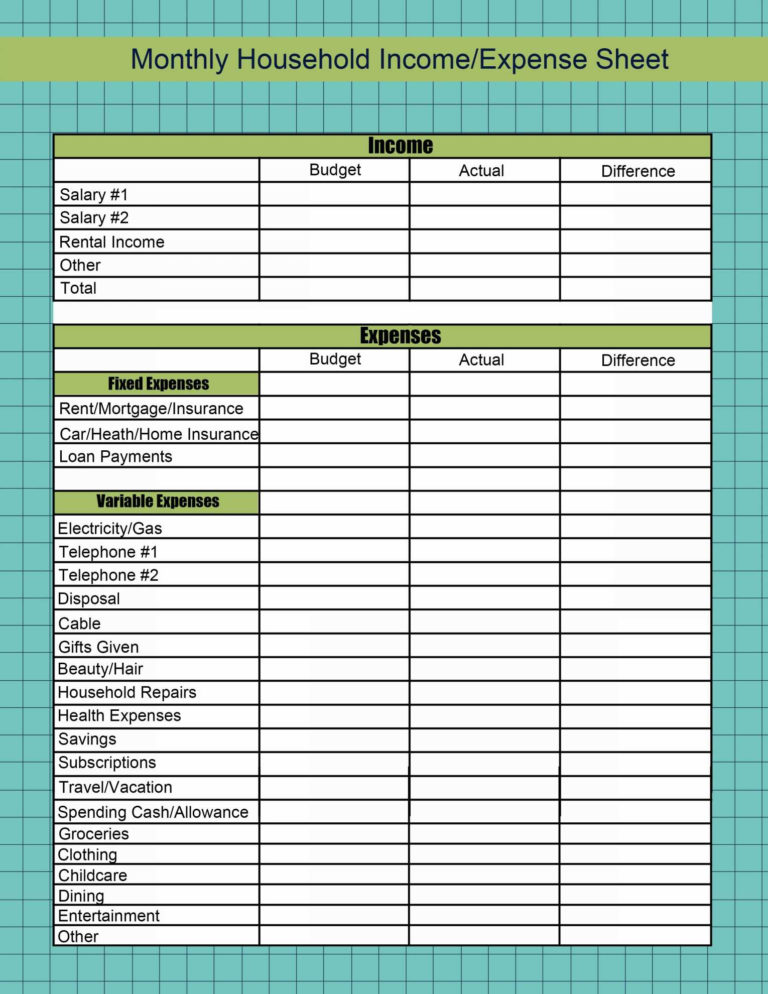

A rental property spreadsheet is a document that keeps all of your property expenses and income data in one safe, verifiable place. It helps property owners keep track of monthly rent costs and property taxes, and it calculates the totals of any property-related expenses owed.

Free Landlord Template Demo Track Rental Property In Excel Rental Property Management

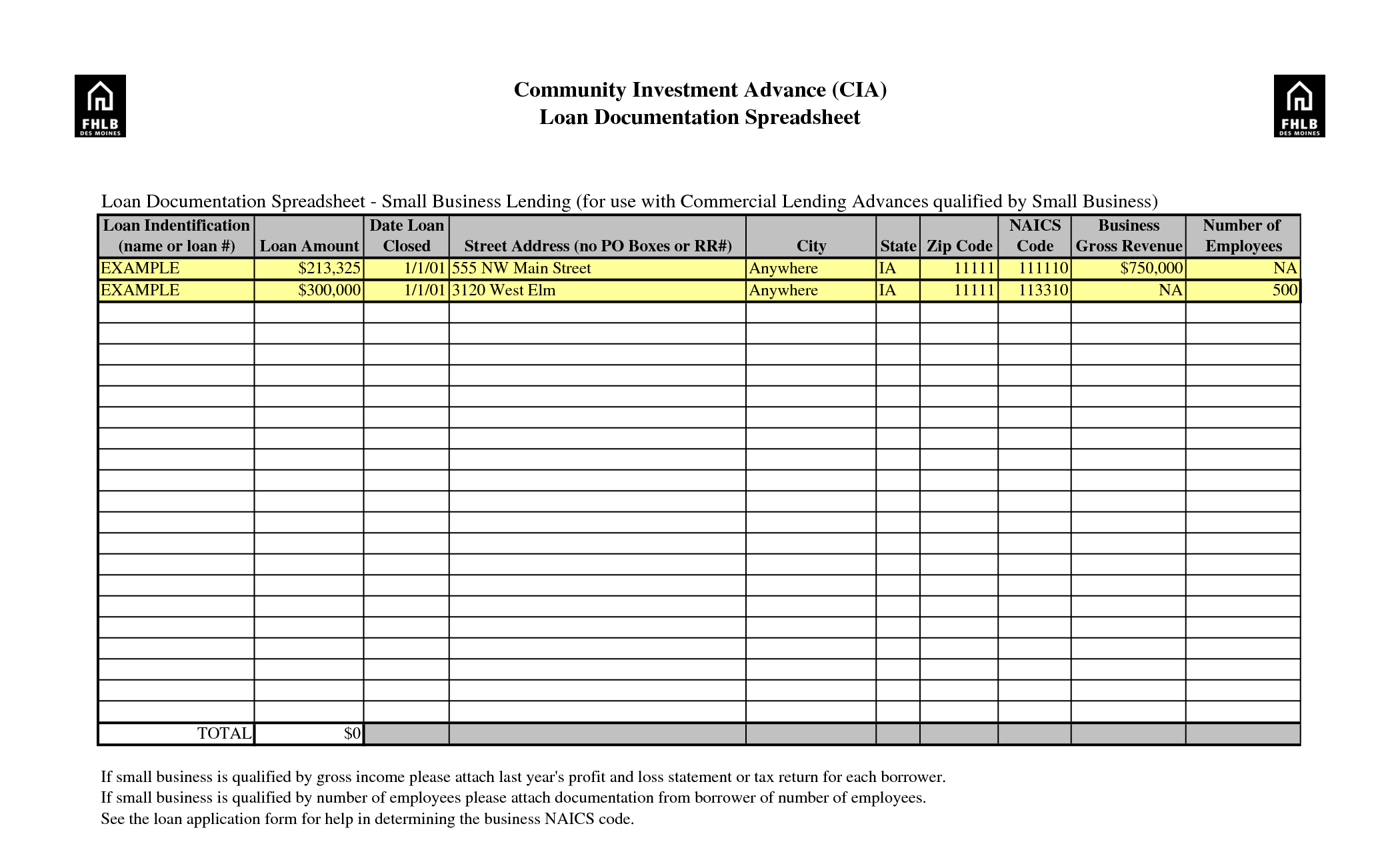

New fields that are lodged to the ATO: Name of rental property; Ownership % (mandatory) Gross rent fields. Updated fields: Income To enter other rental related income, click the Total other rental related income field and press Alt +S to open a grid. Previously, you may have noticed a breakdown of the other rental fields listed, but we've made this change as only the total amount is sent to.

rental property spreadsheet template free —

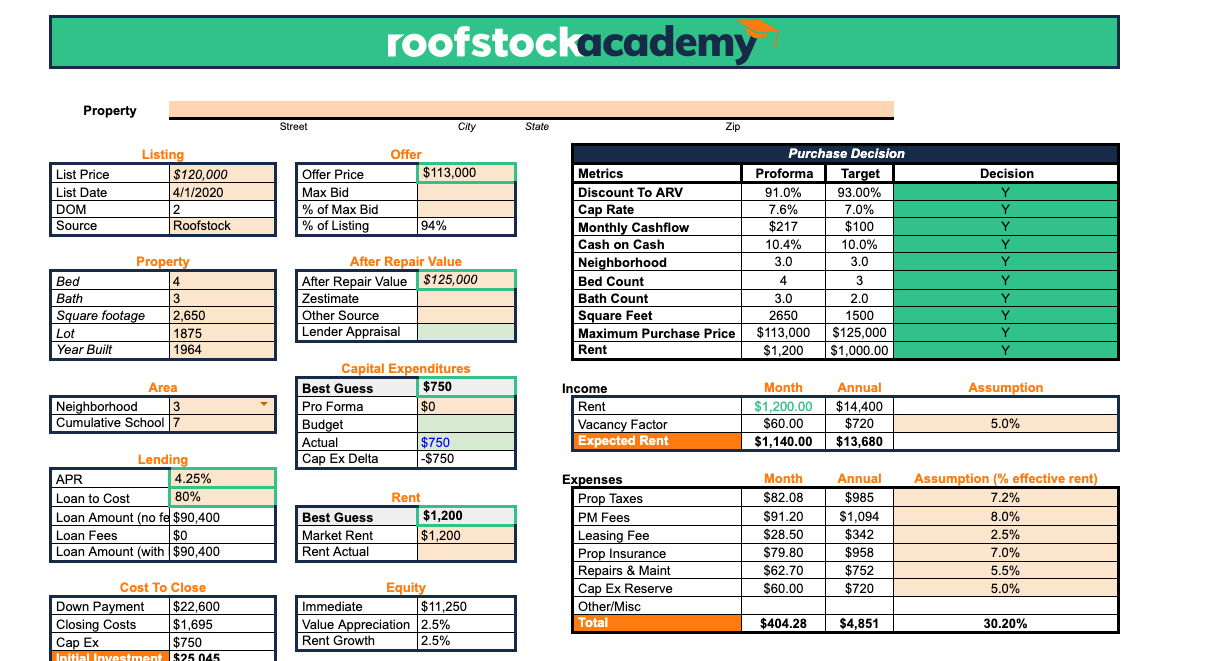

How to Create a Rental Property Analysis Spreadsheet Begin by choosing a spreadsheet software program such as Google Sheets, Microsoft Excel, LibreOffice Calc, or Open Office Calc. Doing a rental property analysis on a spreadsheet makes updating much easier when you are analyzing multiple options before choosing the best property to invest in.

A Free and Simple Rental Property Analysis Spreadsheet

The following completed worksheet is an example of how to work out your net rental income or loss. Some of the figures have been drawn from the examples in this publication; others have been included for illustrative purposes. A blank worksheet is also provided for you to work out your own net rental income or loss.

Free Rental Property Expenses Spreadsheet Templates Best Collections

A rental property analysis spreadsheet is essential when evaluating income-producing real estate's current and future performance. A good rental property spreadsheet organizes income and expense data from each real estate investment and forecasts their potential profitability.

Rental Property Balance Sheet Excel Template Template 1 Resume Examples 0g27LBb9Pr

Overview. This basic investment property calculator is built based on ATO rental property spreadsheet. It automatically calculates the income tax before and after deductions. It in addition shows the gross rental yield of your investment property. Here is a screenshot that will give you a better idea that what you need to do and what this basic.

Free Property Management Spreadsheet Excel Template For Tracking Rental And Expenses

Keeping rental property records Records you need to keep for your rental property income and expenses and how long to keep them. Worksheet - work out your net rental income or loss Worksheet example and copy for you to work out your net rental income or loss. Other tax considerations

Free Rental Expense Spreadsheet regarding Property Management Expenses Spreadsheet Sample

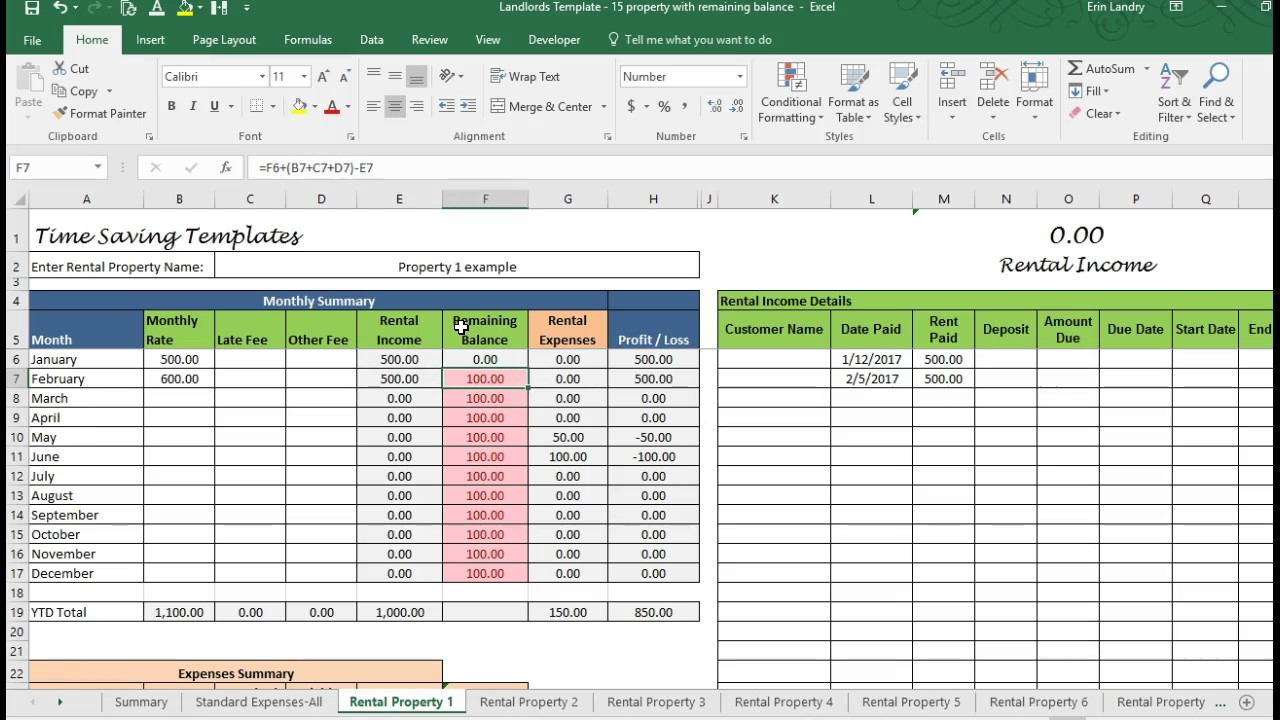

. It will estimate the tax deductions of individual properties as well as your property portfolio. This property rental workbook can save you at least $100 per year because it is free. You can use it for calendar year or financial year. Rental Property Management Spreadsheet

Sample Spreadsheet For Rental Property —

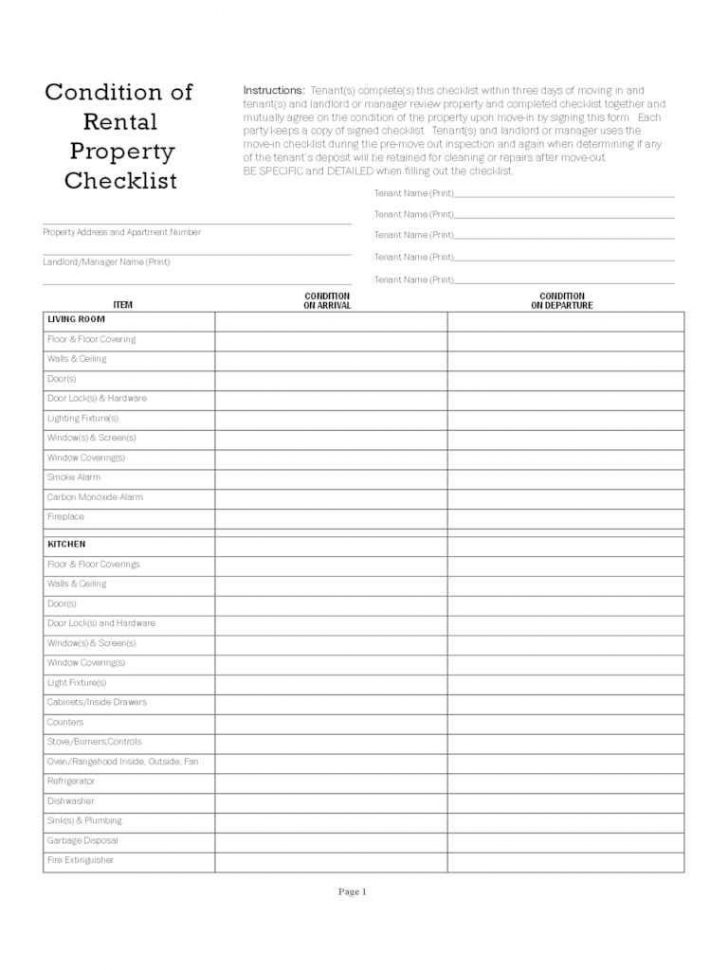

Land Development Checklist. This checklist outlines the typical process developers should. go through, from looking at a property prior to purchase. to evaluating the site potential, obtaining development. approvals, and preparing finished lots for sale to builders. Land development today involves a rigorous, comprehensive.

Rental Property Excel Spreadsheet within Free Property Managementreadsheet Excel Template For

A rental property spreadsheet is a comprehensive report that monitors the financial performance of a rental property. There are 6 steps for creating a landlord rental property spreadsheet: 1. Rental property information This section of the spreadsheet contains information about the rental property:

Rental Expense Spreadsheet For Rental Property Tax —

Key takeaways. A move out checklist documents the condition of the rental property when the tenant moves out. A landlord benefits from a move out checklist by minimizing potential disputes with the tenant and receiving the property in clean condition. A move out checklist may make it easier to identify any damage caused by the tenant.

Rental Property Worksheet —

This free rental property management spreadsheet can help it to keep track of above to 10 investment immobilie (rental expenses, income, etc). Most of us don't want to pay forward complicated accounting software or other technical software packages - that's why EGO developed this simple but high-performance Financial Property Administrative.

Rental Property And Expense Spreadsheet Template for Rental Expense Spreadsheet — db

Use our free worksheet template to simplify management of your rental finances, or use it as a starting point to create your own. It's easy to set up online rent payments with Zillow Rental Manager, the simplest way to manage your rental. Note: This is a Microsoft Excel document.

Rental Property And Expense Spreadsheet Template

NOI / Home Equity = Cash-on-cash ROI. The cash-on-cash return is typically used for rental property investments paid for in cash. If you paid $200,000 cash for a rental property, the net operating income (NOI) would equal $7,200, and the home equity would equal $50,308. The cash-on-cash ROI would equal 14.31%.