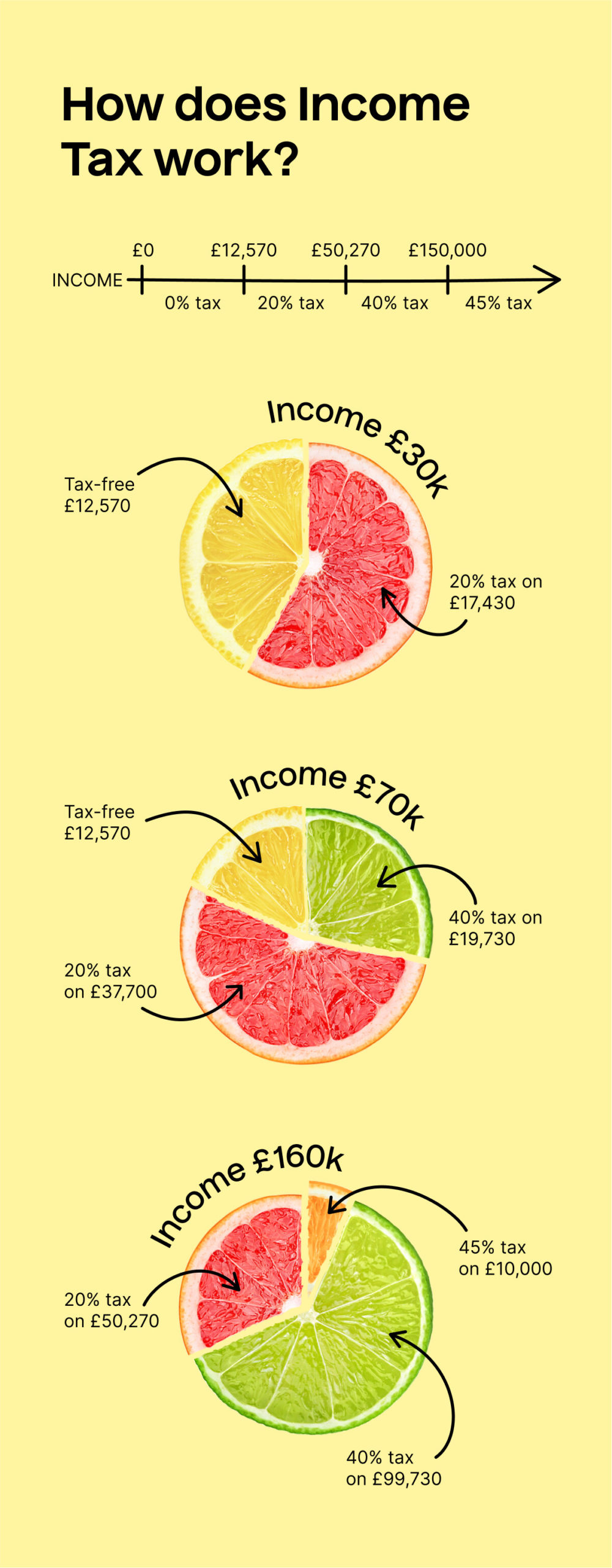

tax rates in the UK TaxScouts

Accelerated Assessment (Assessment during previous year itself) Every assessee is liable to be assessed during the assessment year, for the income earned during the previous year. However in certain circumstances an assessee will be assessed during the previous year itself. This is called 8 accelerated assessment 9.

notice of assessment singapore Paul Wan & Co

This amount is reduced by the prior (2021) tax inclusion amount of $8, which results in the recognition of $92 of revenue for tax purposes in 2022. Taxpayer is entitled to a $60 COGS deduction for tax purposes in 2022, as ownership of the goods passed to the customer in 2022. The result to Taxpayer in 2022 is gross income for tax purposes of $32.

HighPitched Assessment by Tax Dept with unusual determination of Rate of Gross Profit

On January 12, 2024, IRS will host a webinar, Sailing Through the Rules of Refundable Credits. Tax professionals will receive the most current information about the latest changes to the rules for the Earned Income Tax Credit, Child Tax Credit, Additional Child Tax Credit, and the American Opportunity Tax Credit for tax year 2023 returns.

Making the Tax Fair Zenconomics

The guidance in ASC 740 applies to taxes (and thus uncertain tax positions) that are "based on income." It should not be applied by analogy to non-income-based taxes, such as sales taxes, value-added taxes, or property taxes. Entities have historically applied ASC 450, Contingencies, to the recognition of non-income-based tax exposures.

Tax Assessment Types of Assessment under Tax Act, 1961

Even if tax changes are adopted, an acceleration strategy does not make sense in all circumstances. Some taxpayers will not face higher marginal tax rates in 2022. For example, C corporations generating up to $400,000 of taxable income would see their marginal U.S. federal income tax rates drop from 21% to 18% under the House proposal.

Residential Aged Care Fee Assessment Form Printable Printable Forms Free Online

Deduction for state and local taxes paid:, it allows taxpayers to deduct up to $10,000 of any state and local property taxes plus either their state and local income taxes or sales taxes. Deduction for mortgage interest paid: Interest paid on the mortgages of up to two homes, with it being limited to your first $1 million of debt.

Extension of timelines for filing of returns and various reports of audit for the

Editor: Christine M. Turgeon, CPA. Sec. 451 governs the timing of including an item in income.. The 2017 law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, made significant changes to Sec. 451.The TCJA added new Sec. 451(b), which accelerates the recognition of income for certain accrual-method taxpayers, and Sec. 451(c), which codified the existing one-year deferral for certain.

Appeal the Tax Assessment, not just the Deliberate Penalties. Compton Taylor

Also, it's shown separately in box 12 with code C. Box 12 will also show the amount of uncollected social security and Medicare taxes on the excess coverage, with codes M and N. You must pay these taxes with your income tax return. Include them on Schedule 2 (Form 1040), line 13. For more information, see the Instructions for Forms 1040 and.

Reassessment u/s 147 of Tax Act After Expiry of Four years from End of Relevant Year of

Currently, as a result of multiple tax cut bills passed starting in 2018, state income tax brackets and rates are being reduced until most taxpayers would pay 3.9 percent by 2026. Reynolds.

How to Pay HMRC Self Assessment Tax Bill in the UK

Accelerated Assessments means any regular Assessments that have been accelerated and made due and payable immediately, that would not otherwise be due until a future date, pursuant to the Association 's governing documents or state or local statutes. Sample 1 Based on 1 documents Examples of Accelerated Assessments in a sentence

tax self assessment Money Donut

In 2023, processing and return acceptance began on Jan. 23. This year, the due date for tax returns will fall on April 15 for the first time since 2019. In 2020, the deadline for taxes was pushed.

[PDF] Tax Assessment Form 202021 PDF Download InstaPDF

In income tax, the accelerated assessment is a special provision that allows taxpayers to expedite the assessment and payment of their tax liability. The accelerated assessment process is designed to reduce the time and resources required for the tax authorities to process tax returns and collect taxes owed.

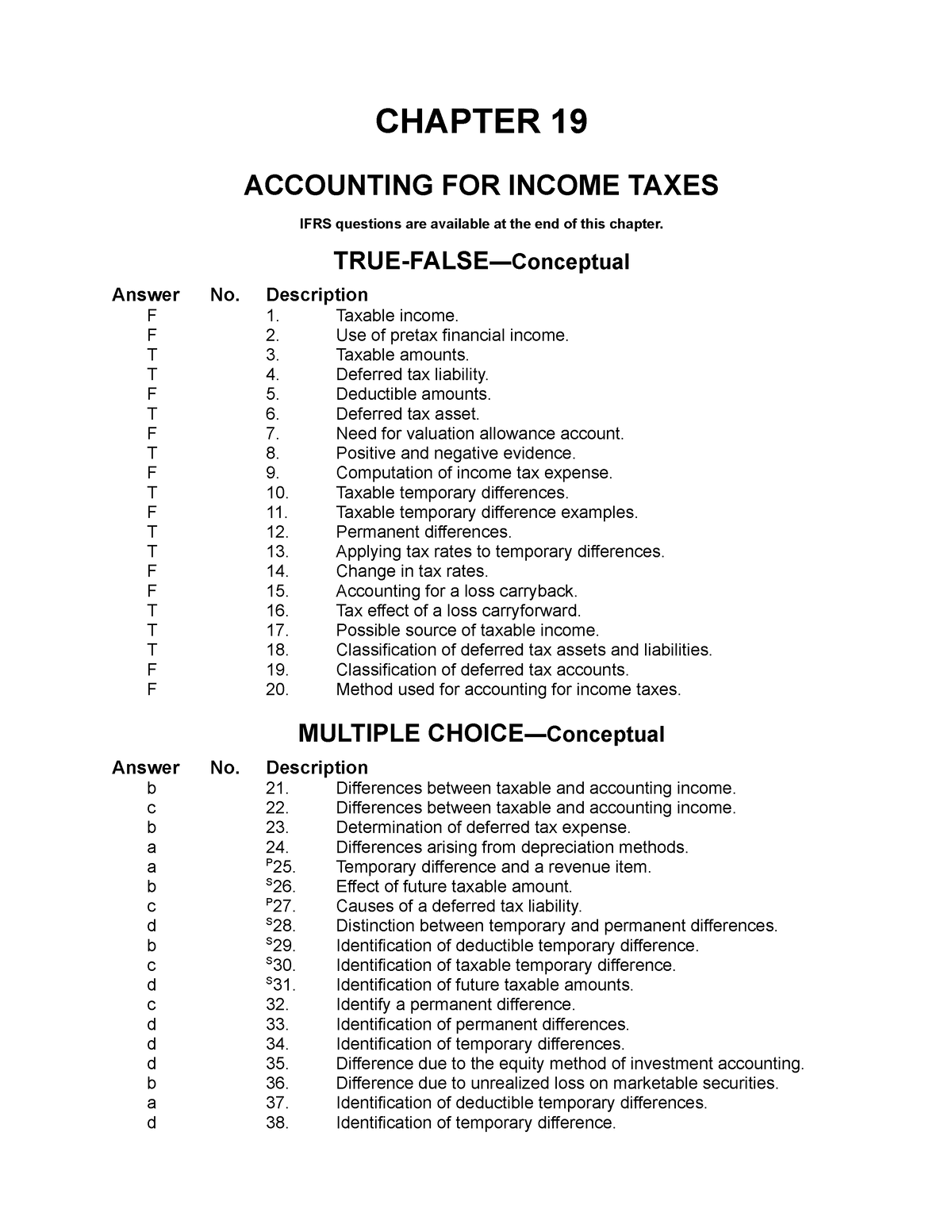

Ch19 Practice test CHAPTER 19 ACCOUNTING FOR TAXES IFRS questions are available at the

IR-2024-04, Jan. 8, 2024 WASHINGTON — The Internal Revenue Service today announced Monday, Jan. 29, 2024, as the official start date of the nation's 2024 tax season when the agency will begin accepting and processing 2023 tax returns. The IRS expects more than 128.7 million individual tax returns to be filed by the April 15, 2024, tax deadline.

Challan 280 Self Assessment & Advanced Tax Payment Learn by Quicko

There are four types of accelerated assessments: Jeopardy assessments, initiated when collection of tax is in danger and the tax is due, but there is no return on file (neither a voluntarily filed return or IRS return prepared under IRC 6020 (b) authority) Termination assessments, initiated by Examination and used to assess income tax.

Company UTR Number A Guide Mint Formations

IR-2024-03, Jan. 5, 2024 — With the 2024 tax filing season just around the corner,. A significant number of taxpayers eligible for refundable credits such as the Earned Income Tax Credit or Child Tax Credit choose to enlist the assistance of tax preparers and rely on paid tax professionals to accurately file their returns. The IRS reminds.

Tax Escaping Assessment Objectives Notices under Section 148

The IRB has published PR No. 6/2022: Accelerated Capital Allowance, dated 22 December 2022. This new 35-page PR replaces PR No. 7/2018, which was issued on 8 October 2018 (see Tax Alert No. 22/2018). The new PR comprises the following paragraphs and sets out 17 examples: 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0