How to Calculate GP Fund Profit GP Fund Interest Calculation GPF Calculation Employees

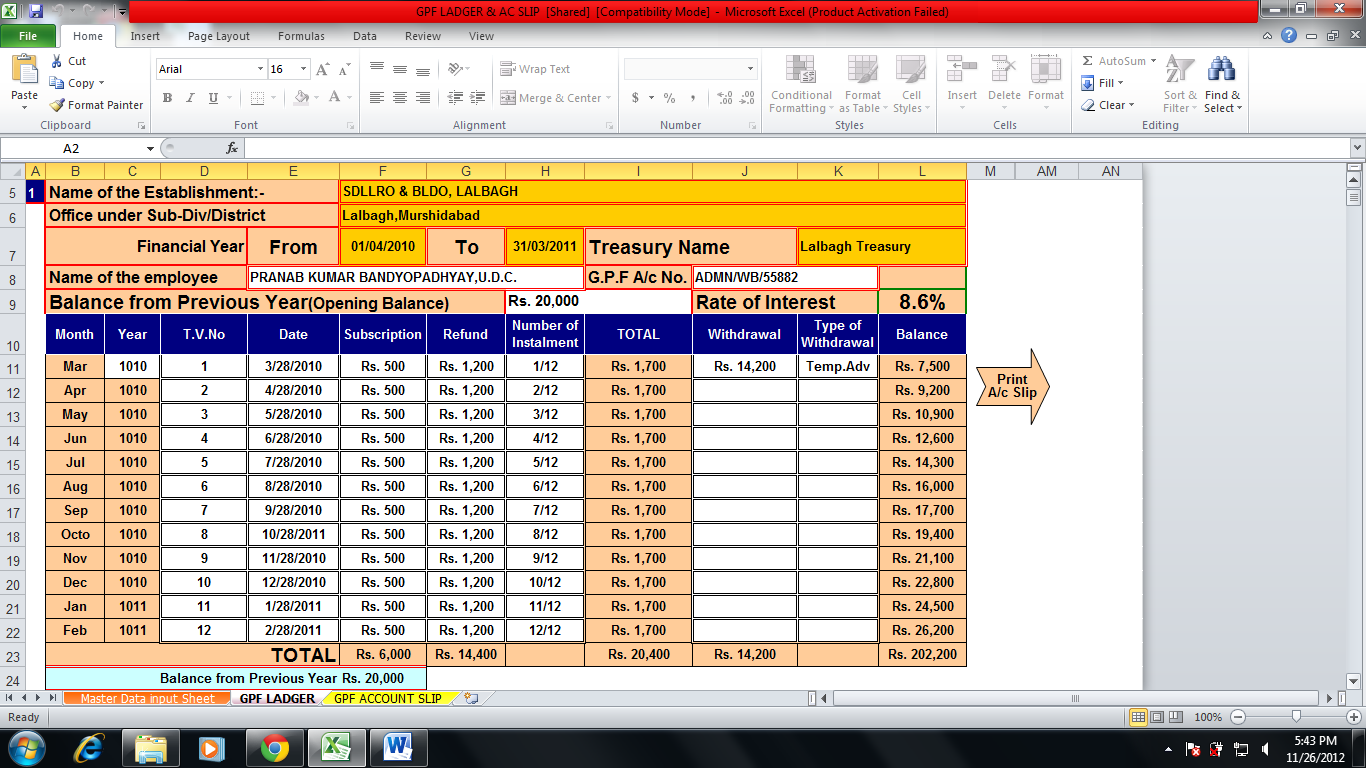

It must be prepared in M.S. Excel. 30% bonus was remained allowed on interest/profit up to 1999-2000, but later on, discontinued. Opening Balance can be zero.

GPF Interest Rate from July to September 2020 Central Government Employees News

This is the formula to calculate GPF Interest: (Total of monthly interest bearing GPF balance/12)* (interest rate*100) Note this formula for academic interest but never do your GPF interest calculation manually any more as we have provided this easy to use online GPF interest calculation tool. How to use this Tool? Just fill up four fields. 1.

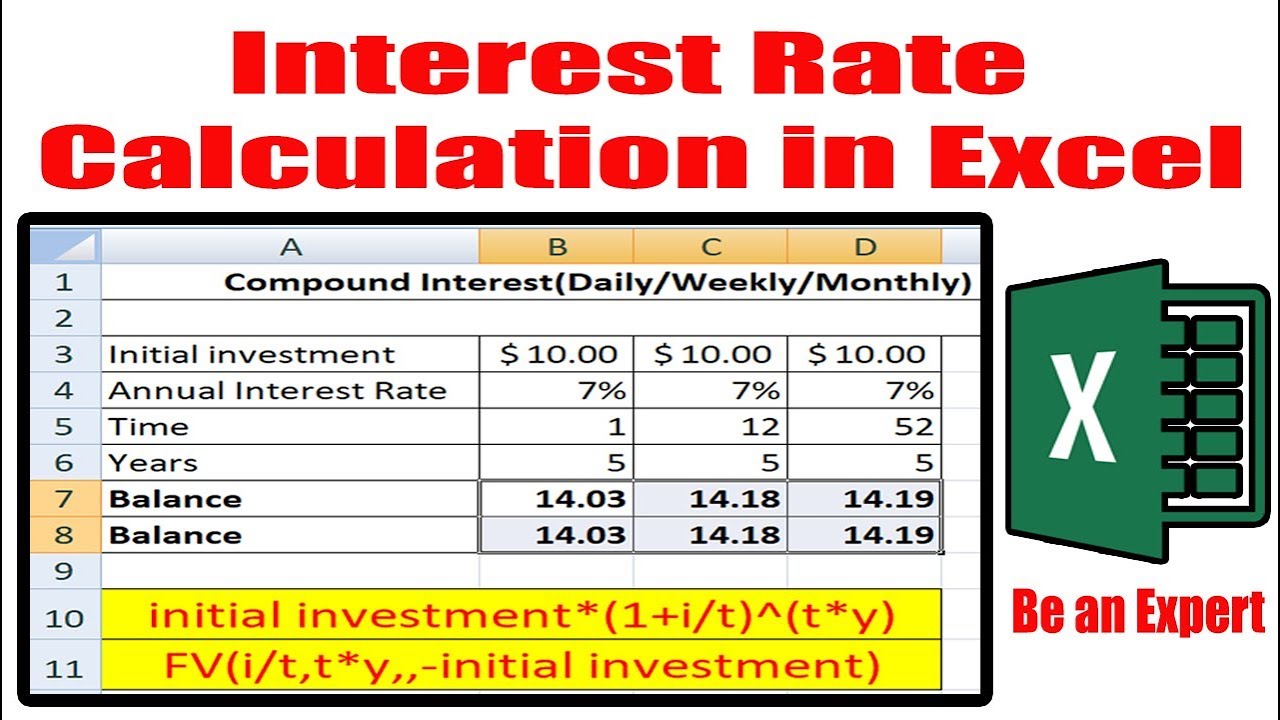

Interest Rate Calculation in Excel YouTube

Interest was then calculated using a formula of (Progressive x Rate of Interest) / (100 x Months), where the result of 1239868 multiplied by 8.7 was divided by the product of 100 and 12. This calculation resulted in an additional Rs. 8,989 being added to the account. The grand total in the account then became Rs. 1,31,178.

GPF Calculation Formula General Provident Fund Statement

This is the formula to calculate GPF Interest: (Total of monthly interest bearing GPF balance/12)* (interest rate*100) Note this formula for academic interest but never do your GPF interest calculation manually any more as we have provided this easy to use online GPF interest calculation tool.

General provident fund calculator in excel Taxalertindia

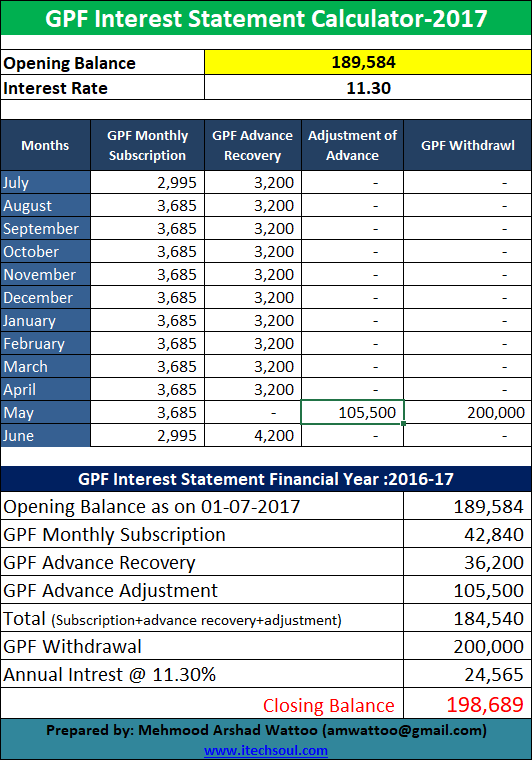

GPF interest Calculation Work Sheet; Month: Monthly Subscription: GPF Advance Recovery: Enter the amount wihdrawn in the appropriate month: Enter the amount drawn as advance in the appropriate month:. GPF interest for this year: GPF Balance (including interest) at the end of the year.

GPF Interest Rate Table PDF Download TEUT PDF Download

Gpf Interest Calculator In Excel File Format - XLS Download. SEEYEM2000. 10. 1. Comrads, I have attempted a GPF Calculator in Excel, with which, interest on the amount at credit in your GPF a/c can be calculated with effect from 1964. The same is attached. Hope this would be useful to the fraternity in general. Regards.

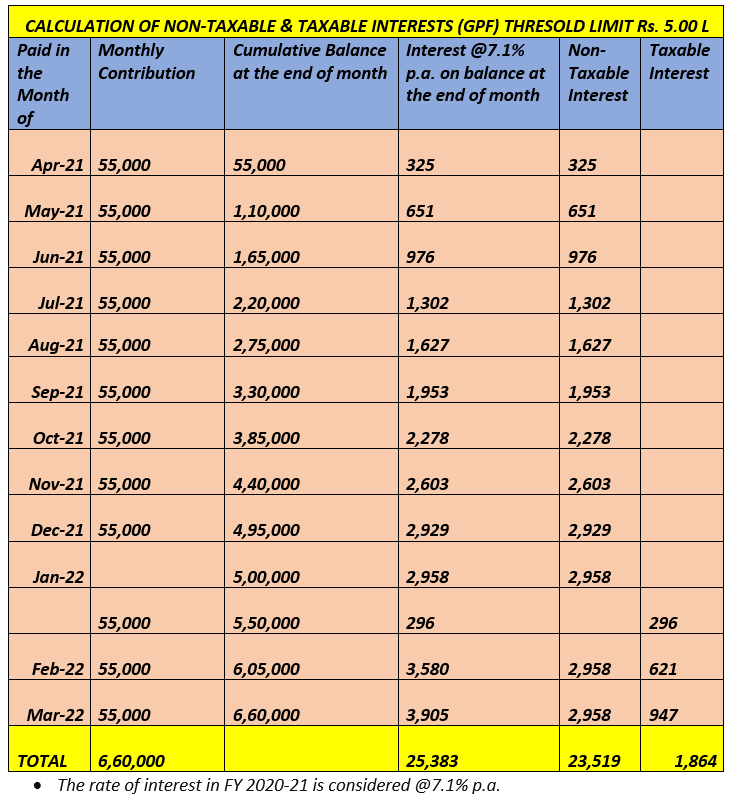

Calculation of Interest on EPF or GPF Tax (Amendment ) Rules, 2021

Select cell B4. Simply click B4 to select it. This is where you'll enter the formula to calculate your interest payment. 7. Enter the interest payment formula. Type =IPMT (B2, 1, B3, B1) into cell B4 and press ↵ Enter. Doing so will calculate the amount that you'll have to pay in interest for each period. This doesn't give you the compounded.

GPF Interest Calculator 202223 Govtempdiary

Step-1: Inserting Primary Data We determine the Provident Fund by using different variables. So we need to insert them first. First, make some columns to store the variables and insert the primary data. We need the amount of Basic Salary, Interest Rate, Basic Increment, Individual and Company Contributions.

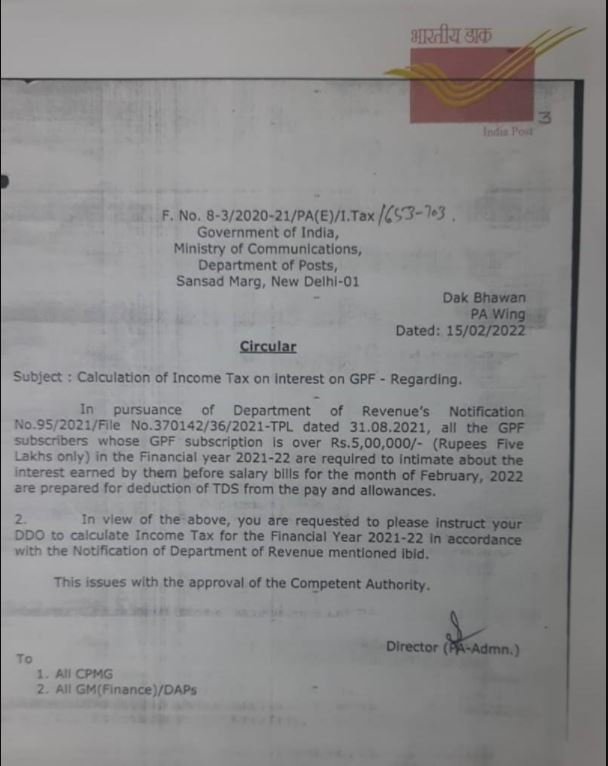

GPF Interest Calculation On Above 5 Lakhs For Deduction Of TDS From The Pay And Allowances

Subject: Calculation of Income Tax on Interest of GPF- Regarding. Please refer MoF Department of Revenue (CBDT)'s notification No.95/2021/File No. 370142/36/2021-TPL dated 31-08-2021 (Copy enclosed) regarding deduction of Income Tax on interest of GPF subscription over Rs. 5 Lakhs during the financial year 2021-22. 2.

GPF Interest Rate Table from 1967 to 2023

GPF CALCULATION - INTEREST . EXTRACT OF RULE 12 OF MAHARASHTRA GENERAL PROVIDENT FUND RULES,1998 (Corrected upto 14th February 2017)- Refer Page 7 to Page 10 of the Rules 12. Interest. — (1) Subject to the provisions of sub-rule (5) Government shall pay to the credit of the account of a subscriber interest at such rate as may be determined for each year according to the method of calculation.

How to Calculate GPF Interest in Excel (with Easy Steps)

This Excel Utility will calculate and generate Account Slip of Provident Fund. Please fill in the data carefully. You may change the rate and amount of subscription at any time. Select the appropriate case type. There are 3 types, Normal Case, Retirement Case and Death Case.

GPF Interest rate at 7.1

GPF Interest Calculator 2020-21. GPF Calculator 2023-24. Enter Opening Balance as on 1st April 2023. Month. Monthly Contribution. Interest Rate (%) Withdrawal Amount. Balance.

[PDF] GPF Interest Rate 202122 PDF Download

GPF Interest Calculator GPF Interest Rates GPF Interest Calculator : General Provident Fund Rules, Interest rates, calculator. Calculate the GPF value based on deposit and withdraw amount

GPF Interest Statement Calculator_Example

The rate of interest in FY 2020-21 is considered @7.1% p.a. ACCOUNTS TO BE MAINTAINED IN EPF/GPF BY THE CONCERNED DEPARTMENT The accumulated balance in GPF Account of Mr. Aman is considered of Rs. 30.00 Lakhs as on 31/03/2021. The Rate of Interest in GPF Account for FY 2021-22 is considered @7.1% p.a.

GPF Interest Rate January to March 2023 PDF — Central Government Employees Latest News

How to use this Tool? Just fill up four fields. 1. Opening Balance of GPF at the beginning of the year, 2. Monthly subscription amount, 3. monthly advance recovery if any and 4. Select the Year for which you intend to calculate GPF Interest . Then click "Calculate GPF Interest" Button. That's it! Your GPF work sheet is ready.

GP Fund Interest Rates GPF Interest Rates in PDF Format GPF Calculation Employees Corner Zia

Calculate GPF interest in One sheet Individual ledger, Form X, Broadsheet all in one using Excel .Blog detail in text with picture you can download from he.