ORDER BLOCK INDICATOR CLEVER TRADING CLUB My Trading 2 October

What Are Order Blocks and How Do They Form? 3 Identifying Bullish and Bearish Order Blocks Bullish Order Blocks Bearish Order Blocks 4 How to Trade Order Blocks: A Step-by-Step Strategy Identifying Order Blocks Waiting for the Return Choosing Your Target 5 Using an Indicator to Spot High-Probability Order Blocks

Cách sử dụng Order Block (Khối lệnh) để giao dịch cùng hướng với Big Boy

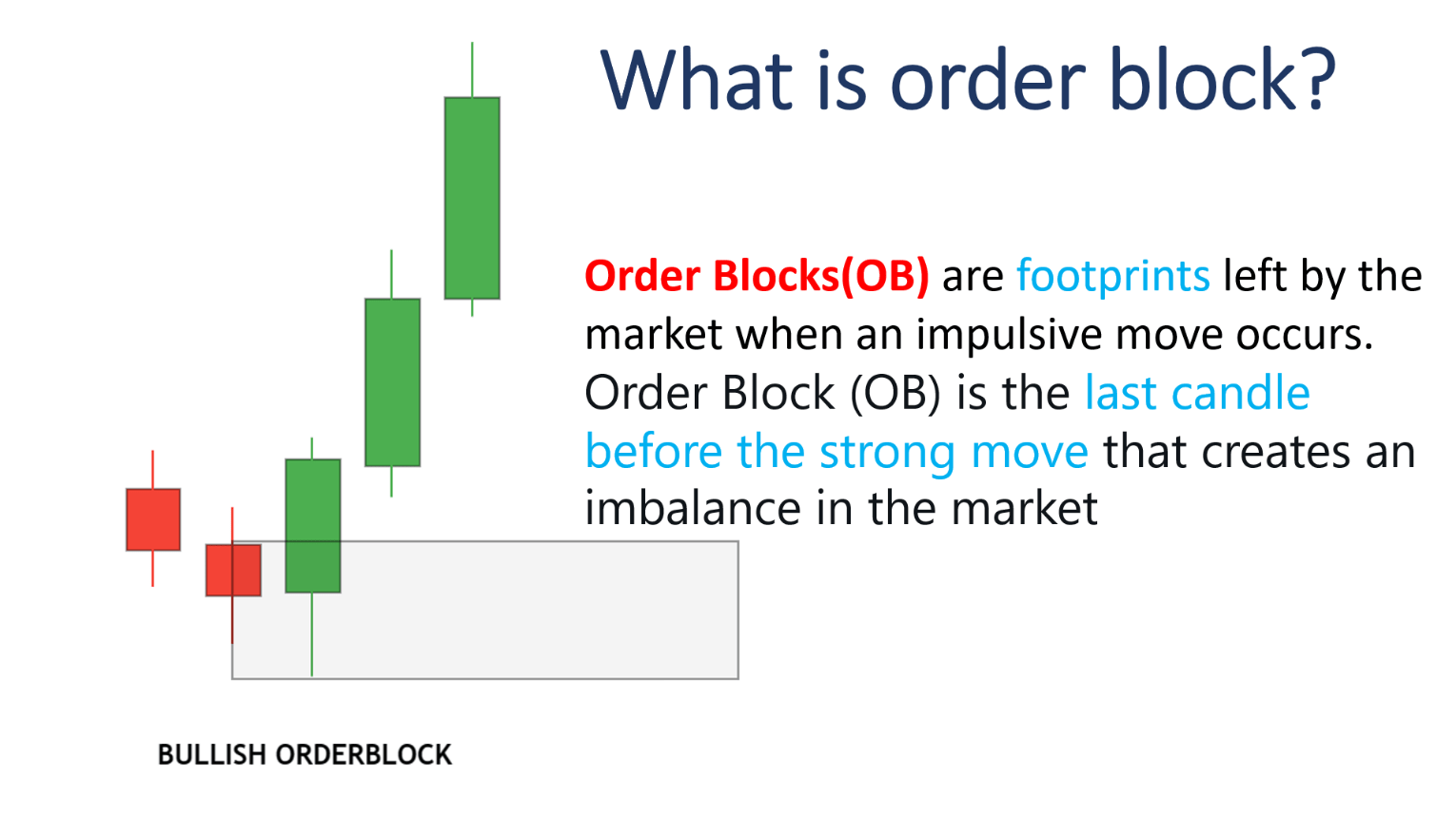

14 0 Order Blocks Explained Now we'll look at one of the important concepts we utilize to find our precise entry points: order blocks. So, what exactly is an order block? An orderblock is a visible spot on the chart where a large order is being placed on the market. You'll notice the order being placed, followed

Order Block Trading Strategy with Examples Dot Net Tutorials

Here's a step-by-step guide to trading order blocks: 1. Identify order blocks

How To Find And Use ICT Order Blocks In Your Trading PriceActionNinja

1. Pin bar and order block Trading Strategy The pin bar trading strategy combines well with the order block. The idea is to locate a bullish or bearish order block, and whenever the price returns to these levels, creating a pin bar, we can enter our trades.

Order Block Definition Forexpedia™ by

A block trade is a large, privately negotiated securities transaction. Block trades are generally broken up into smaller orders and executed through different brokers to mask the true size..

Order Block Trading Strategy 3 Strategies Explained ForexBee

At its core, an order block is a substantial accumulation of buy or sell orders set at a particular price range by large financial institutions and traders. These entities, often called " smart money ," have the market clout to influence currency prices significantly.

Order Block Breakdown for BITFINEXBTCUSD by BoomerangCap — TradingView

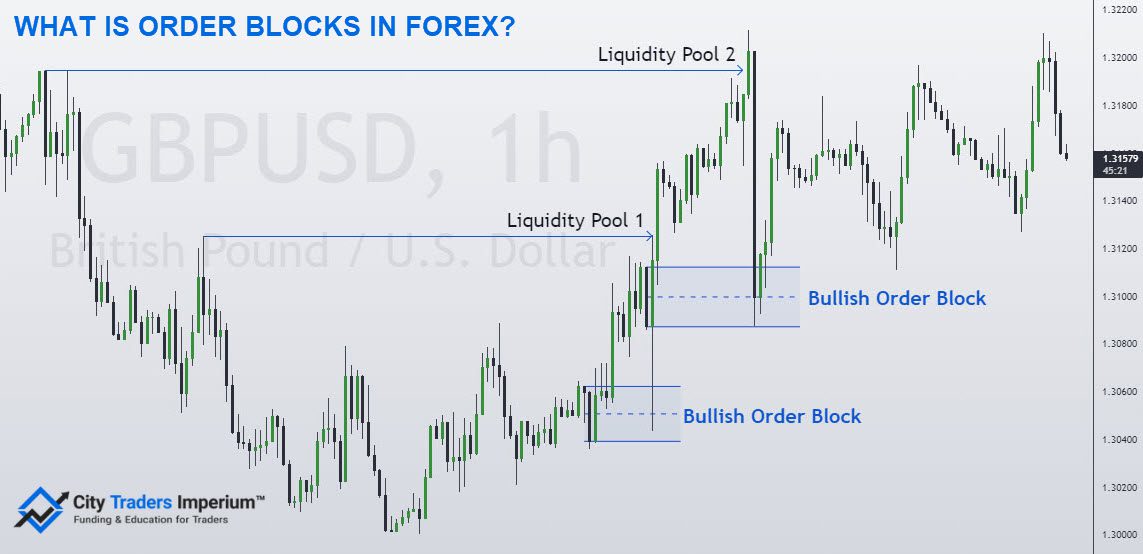

Order blocks function as areas of accumulation or distribution, where institutional traders buy or sell large positions. When the market reaches these levels, the imbalance between supply and demand creates a shift in price momentum.

How To Trade Order Blocks In Forex Trading Explained

Order blocks are created when institutional traders, such as banks and hedge funds, enter large buy or sell orders in the market. These orders are typically executed at specific price levels, creating areas of significant buying or selling pressure. When a large buy order is executed, it creates a block of orders at a specific price level.

Order blocks forex theforexscalpers

Order blocks is a unique trading technique or theory at which traders aim to identify price levels where large institutions and investors enter the market. In this article, we will explain what order blocks are in the forex market, how to identify these orders, and how to add the order block trading strategy to your trading arsenal.

ICT trade plan using breaker and order block for FXEURUSD by

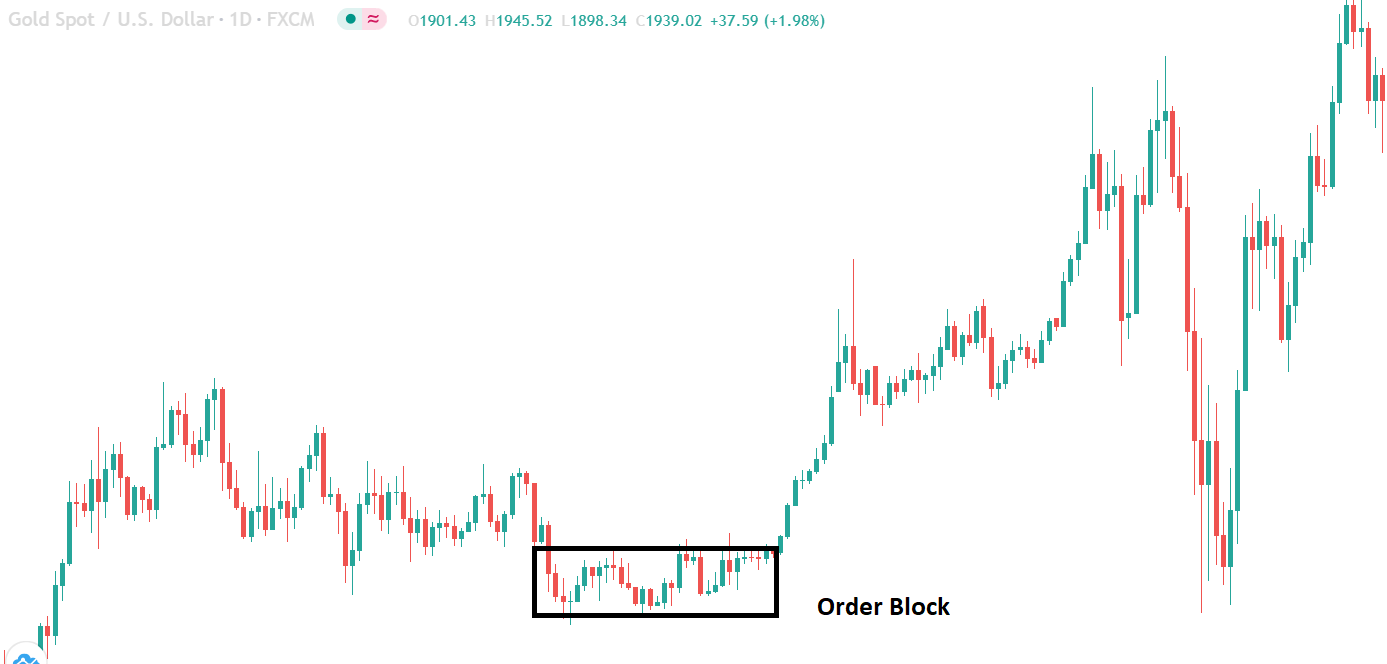

* An order block is a defined area where buyers or sellers of smart money entered market & moved price away from its price level to a new area of interest. Why Order Blocks: * The market is engineered by smart money by means of creating levels within the market place for them to use at a later date and time. How To Identify Order Blocks:

Order Block Trading Strategy and PDF Guide Free Download

A forex order block forms when a group of buying or selling orders builds up within a specific price range. These blocks exhibit a unique zone on the chart where market participants have executed.

Order Block in Forex Trading All You Need To Know Forex Traders Guide

The term 'orderblocks' refers to certain candlestick formations or bars that suggest what is known as 'smart money buying and selling' when viewed in an institutional context (i.e the foreign exchange transactions between central banks, commercial hedgers and institutional traders) displayed on price charts.

Forex Order Block Strategy for Beginners Lux Trading Firm

So what's an Order Block? An Order Block is a handy tool that helps us see where the big guys are likely to put their money. It's like a secret sign where big businesses gather their orders before diving into the market around areas known as Order Blocks.

Order Block In Forex, 4 Insane Rules To Add To Your Strategy

OB = ORDER BLOCK The LAST BULLISH or BEARISH cand before an IMPULSE up or down, represent an OB or Order Block.-Why do we call them order blocks and why are they important? Order Blocks are one type of supply and demand on the market, you can expect them to act as a support or resistance depending on the impulse after them. an OB is where larger players (whales, institutions, banks) have.

Order Block in Forex Trading All You Need To Know Forex Traders Guide

Order blocks are high-volume areas on a price chart where institutional traders place significant buy or sell orders, providing insights into key supply and demand levels in the forex and crypto markets.

What Are Order Blocks In Forex and How Can You Profit From

An Order Block trading strategy is a powerful tool used in the world of financial markets to identify key levels where significant buying or selling activity has taken place. It revolves around the concept of grouping together market orders that have been executed at a specific price level, forming what is known as an order block..