Candlestick Bullish And Bearish Candle Stick Trading Pattern

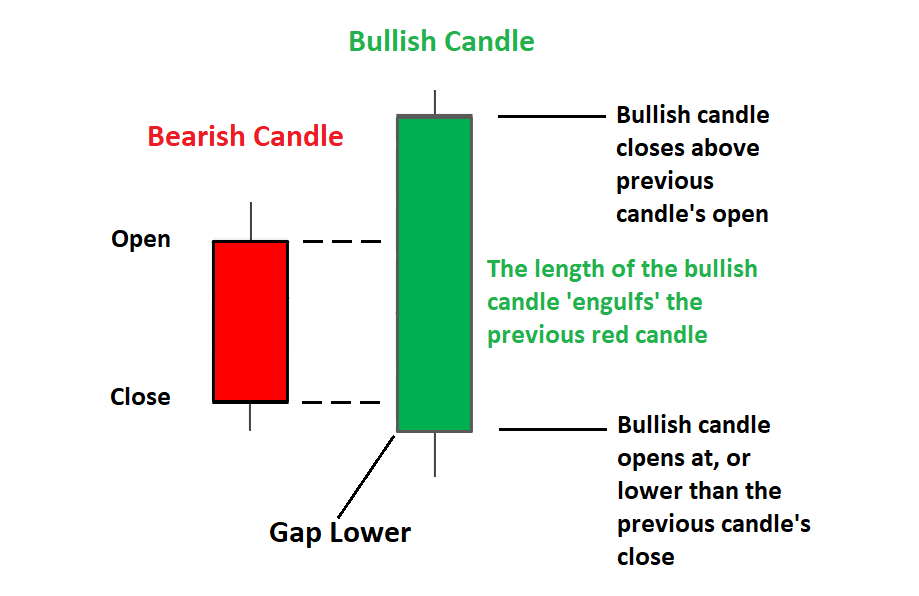

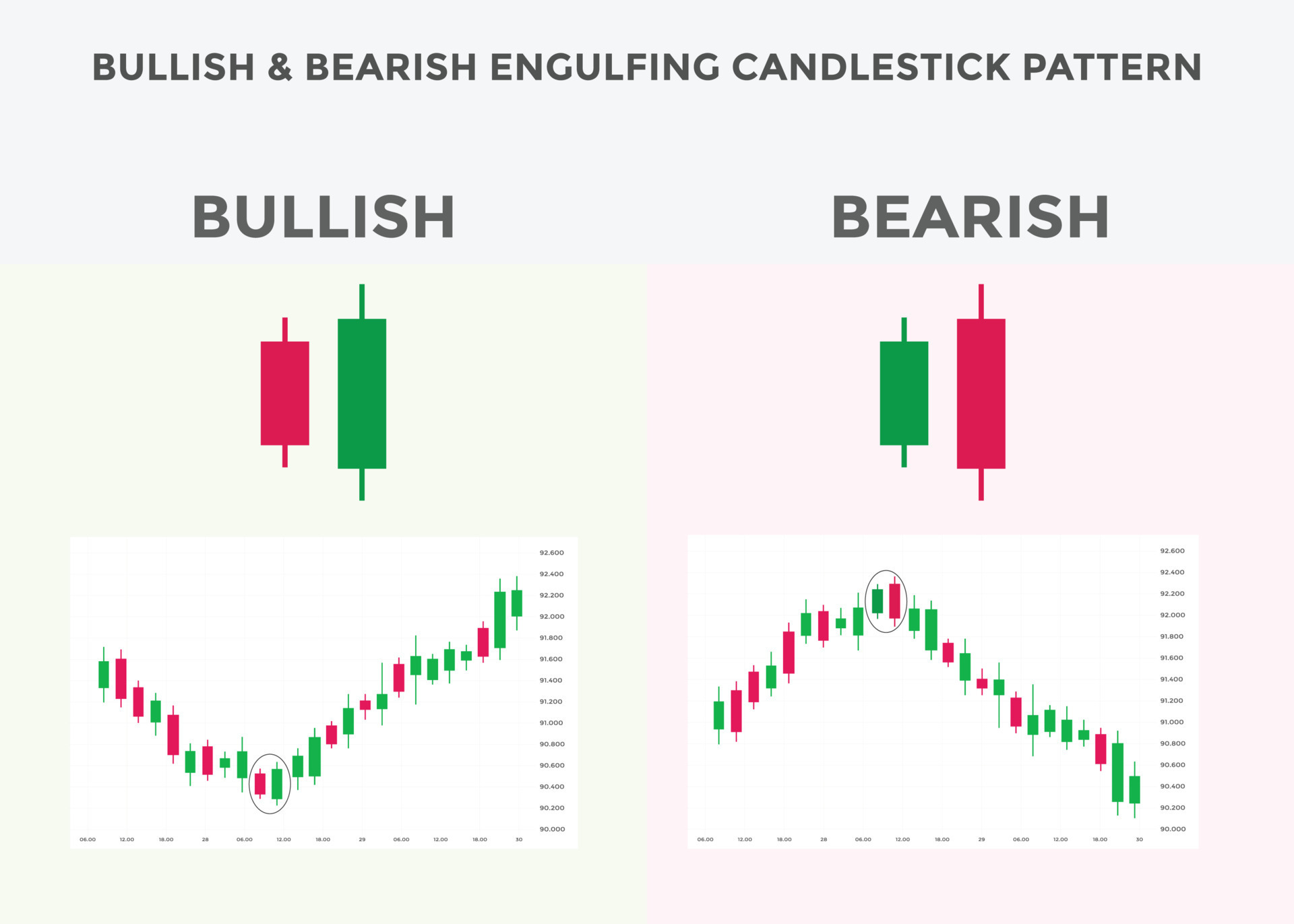

The bullish engulfing pattern is formed of two candlesticks. The first candle is a short red body that is completely engulfed by a larger green candle. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Piercing line

Is A Hammer Bullish Or Bearish Candle Stick Trading Pattern

By Bullish Bears Updated November 7, 2023 7 min read SHARE THIS ARTICLE Bearish candlesticks come in many different forms on candlestick charts. There are also bullish candlesticks. Bearish candles show that the price of a stock is going down. They are typically red or black on stock charts.

:max_bytes(150000):strip_icc()/UsingBullishCandlestickPatternsToBuyStocks1-ac08e48665894dbfa263e247e53ba04e.png)

Using Bullish Candlestick Patterns To Buy Stocks

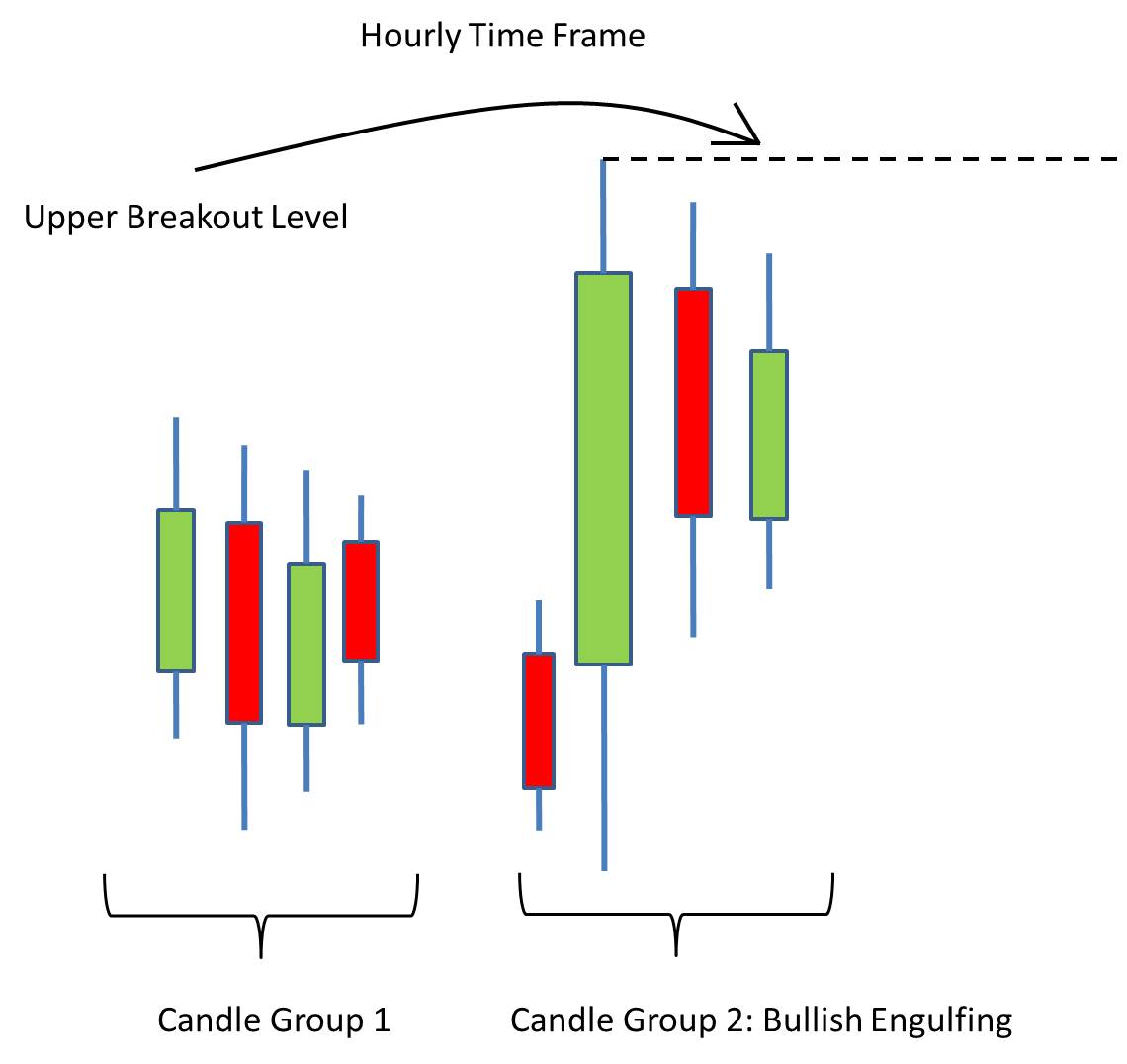

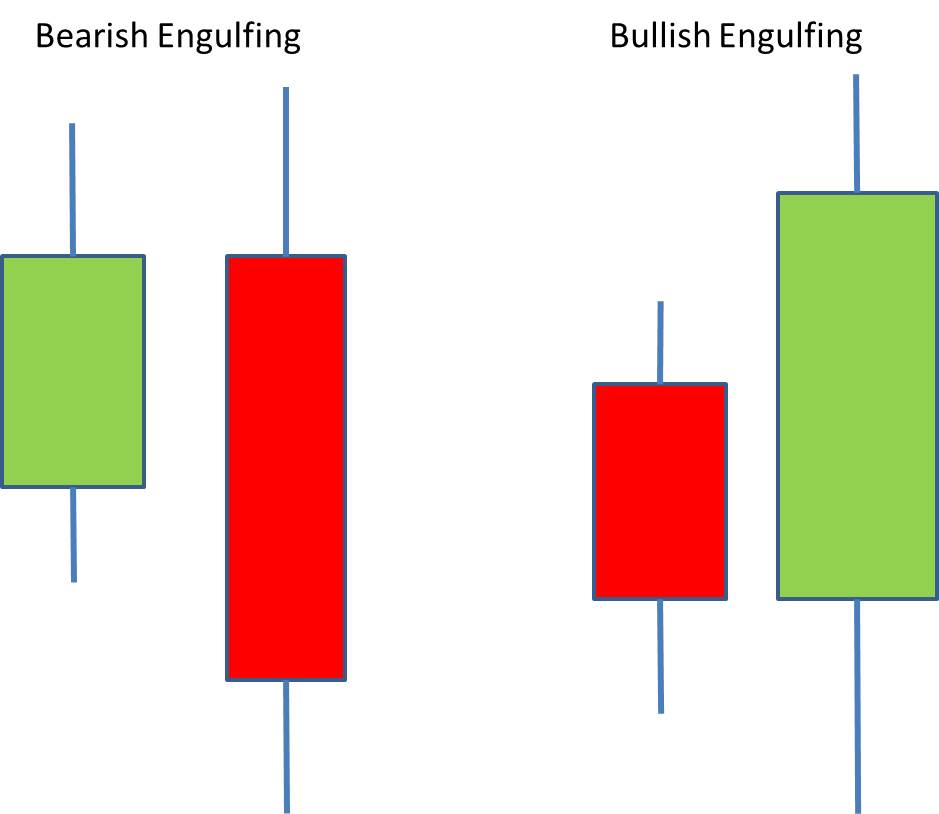

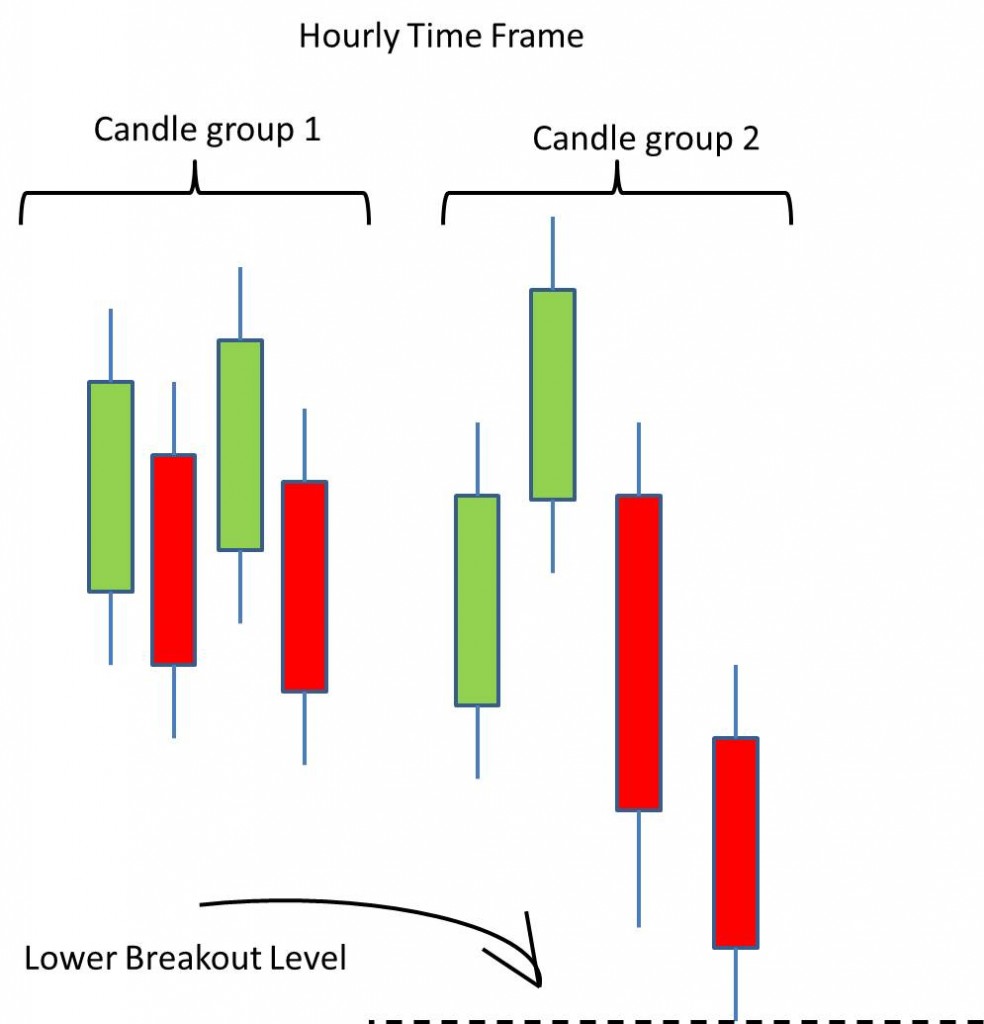

Bullish and bearish engulfing candlestick patterns are powerful reversal formations that generate a signal of a potential reversal. They are popular candlestick patterns because they are easy to spot and trade. Structures A bullish engulfing candlestick pattern occurs at the end of a downtrend.

What Is Bullish Engulfing Candle Pattern? Meaning And Strategy

Bullish candlestick patterns can be used by traders and investors to identify potential buying opportunities. Some common bullish candlestick patterns include the following signals. 1. The.

Candlestick Bullish And Bearish Candle Stick Trading Pattern

A bearish engulfing pattern occurs after a price moves higher and indicates lower prices to come. Here, the first candle, in the two-candle pattern, is an up candle. The second candle is.

How To Trade On Bullish And Bearish Piercing Candlestick Patterns Candlestick Analysis YouTube

Reading Time: 9 minutes A bullish engulfing candlestick pattern is a bullish reversal pattern. Whereas, the bearish engulfing candlestick pattern is a bearish reversal pattern. I'm sure if you have already started to learn about candlesticks then this is something you have undoubtedly heard of.

145 CANDLESTICK PATTERNS PAGE 9 (17) Morning Star ( Bullish ) ; (18) Evening star ( Bearish)

This in-depth guide will help you get familiar with bullish and bearish candlestick patterns and learn how to use them in your daily trading activities. Introduction to Candlestick Patterns How to Read Candlestick Patterns? Bullish Candlestick Patterns Bearish Candlestick Patterns Reversal Candlestick Patterns Conclusion About Candlestick Patterns

Bullish and bearish belt hold candlestick patterns explained on E

Comprising three candles, the evening star pattern starts with a bullish candle, followed by a small-bodied or doji candle, and then a larger bearish candle. It signifies a potential reversal. Here is an image to get a clear idea about an evening star pattern.

Bullish & Bearish Engulfing Bars (Part I) FXMasterCourse

Bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Many of these are reversal patterns.

Bullish & Bearish Engulfing Bars (Part I) FXMasterCourse

In the world of finance, candlestick patterns are a powerful tool used by traders to gauge market sentiment and make informed decisions. They are an essential component of technical analysis, providing insights into the price movements of stocks, cryptocurrencies, or other financial instruments. Bullish and bearish candles, two primary types of candlesticks, play a significant. Continued

Bullish & Bearish Engulfing Bars (Part III) FXMasterCourse

The morning star is a 3-candle pattern that can be used to forecast bullish reversals with a significant degree of accuracy. The first candlestick is usually bearish with a medium-sized or large candle body. This shows the presence of sellers in the market. The second candle is small-sized, preferably one with a small body.

How to read candlestick patterns What every investor needs to know

Bullish Harami Candlestick is a price chart pattern formation that signals a bullish trend reversal. A bullish Harami candlestick comprises two candlesticks including a long bearish candlestick and a short bullish candlestick. The name Harami traces its origin to the Japanese language. Harami in Japanese means :" Pregnant:" It consists of.

Top 6 Most bullish Candlestick Pattern Trade with market Moves

What is a Bearish Engulfing Pattern? A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick.

Bullish and Bearish Reversal Candlestick Patterns in Trading

The Bearish Engulfing pattern involves a smaller bullish candle followed by a larger bearish candle that completely engulfs the preceding one. This pattern indicates a potential shift from a bullish to a bearish trend. The presence of a bearish engulfing pattern signals that sellers are gaining control, suggesting the likelihood of a developing.

Bullish And Bearish Candlestick Charts Candle Stick Trading Pattern

Beginner Elementary Intermediate Experienced Below you can find the schemes and explanations of the most common reversal candlestick patterns. Bullish patterns Bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. Hammer A 1-candle pattern.

best candlestick patterns for forex, stock, cryptocurrency trades. Bullish and bearish engulfing

Most bullish reversal patterns require bullish confirmation. In other words, they must be followed by an upside price move which can come as a long hollow candlestick or a gap up and be.